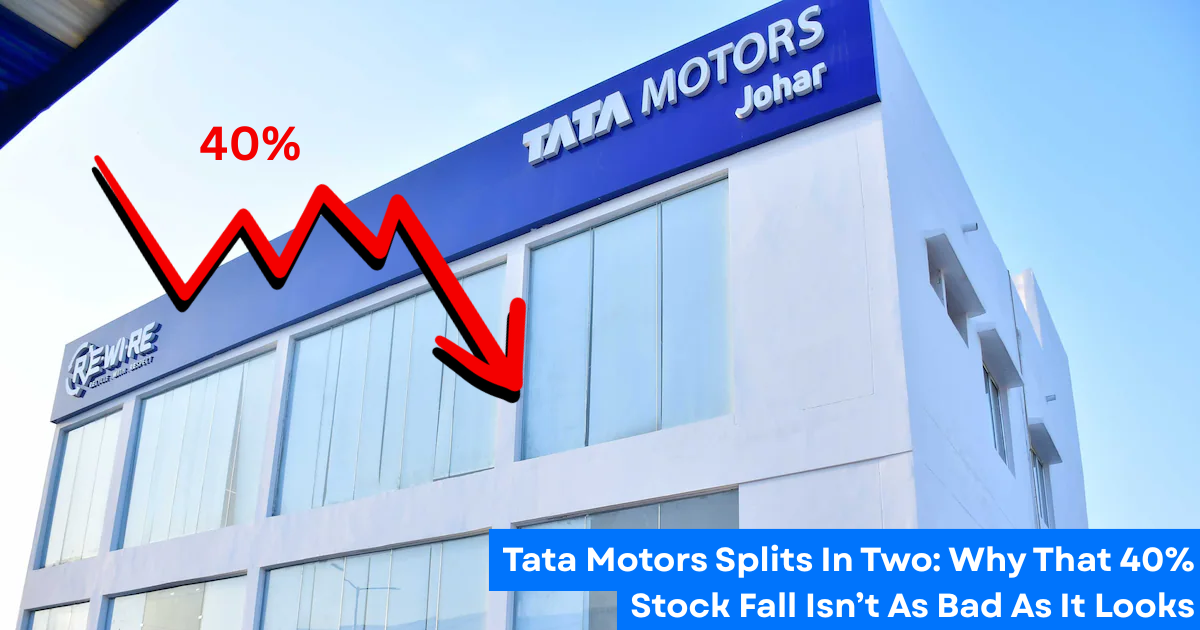

Tata Motors Splits In Two: Why That 40% Stock Fall Isn’t As Bad As It Looks

Tata Motors Splits In Two Why That 40% Stock Fall Isn’t As Bad As It Looks

Tata Motors shares saw a sharp fall of over 40%, slipping from ₹660.75 to ₹395.45, leaving many investors shocked. But this is not a crash — it’s a planned demerger that aims to unlock more value for shareholders.

The drop is only on paper, and the company’s overall value remains the same. This move marks a major turning point for Tata Motors as it prepares for a stronger and more focused future.

Key Takeaways

- Tata Motors completed its fourth major restructure in 80 years, starting on October 1, 2025.

- Shareholders on October 14 get one ₹2 share of the new Commercial Vehicles (CV) company for every Tata Motors share.

- The company is now split into Tata Motors Passenger Vehicles Ltd (TMPVL) and TML Commercial Vehicles Ltd (TMLCV).

- The overall market value of both companies remains nearly ₹1.47 lakh crore.

- Analysts see strong long-term potential, with targets around ₹680 by September 2026.

The New Tata Motors Structure

After the split, the old Tata Motors became Tata Motors Passenger Vehicles Ltd (TMPVL) — focusing on cars, electric vehicles (EVs), and Jaguar Land Rover (JLR). This segment targets premium buyers and the growing EV market.

The newly formed TML Commercial Vehicles Ltd (TMLCV) — soon to be renamed Tata Motors Ltd — will handle trucks, buses, and the upcoming Iveco deal expected to close by April 2026. The unit is valued around 2x CY24 EV/EBITDA, which shows strong earnings potential from day one.

Why The Stock Drop Is Only Temporary

That big 40% drop came from mathematical adjustment, not a real loss. In the special pre-open session on October 14, TMPVL opened near ₹400, and TMLCV’s value was implied at ₹260.75. Adding both gives back the earlier price zone of ₹660–700, showing no change in total worth.

The combined market cap of both firms remains around ₹1.47 lakh crore. TMPVL’s value is already listed, while TMLCV will start trading in November 2025, after regulatory clearances in 45–60 days.

What Analysts Are Saying

Brokerages see this move as a “value unlock”.

- Nomura gave equal targets: ₹367 for TMPVL (supported by EV demand and GST cuts) and ₹365 for TMLCV (driven by infrastructure growth).

- SBI Securities expects TMLCV to trade between ₹320–470 after listing, helped by lower GST from 28% to 18% and Iveco synergies.

- Ambit sees strong export potential for the CV business.

- Nuvama stays slightly cautious due to JLR’s slower demand in some global markets but still expects ₹680 combined by September 2026.

For FY25, Tata Motors reported ₹4.38 lakh crore revenue, ₹21,494 crore profit, and a jump in ROE to 23.96% from an earlier 10.62% average — proving the company’s financial strength.

Key Snapshot

| TMPVL (Passenger) | TMLCV (Commercial) | |

|---|---|---|

| Focus | EVs, JLR, Premium Cars | Trucks, Buses, Iveco |

| September Sales | Record 60,907 Units (YoY Up) | Stable, Infra-Driven |

| Target Price | ₹367 (Nomura) | ₹365 (Nomura) |

| Growth Edge | 30% EV Target By 2030 | 5% FY26 Industry Growth |

The Road Ahead

Tata Motors faced a small hurdle when JLR’s production stopped after a cyberattack in September, but operations restarted on October 8. The company also transferred ₹2,300 crore NCDs to TMLCV and reported employee costs at 10.86% of revenue, both manageable signs.

Market sentiment on social platforms is largely positive. Nearly 80% of discussions are bullish, calling this a “notional drop” and a “game changer.” Traders expect fresh movement once the CV business lists in November.

In the long run, this split removes cross-subsidies and gives each segment freedom to grow — PV for EV innovation and CV for stable cash flows. Promoters hold 42.57%, FIIs 17.17%, and mutual funds 10.18%, showing solid institutional trust.

The stock might stay volatile in the short term, but the foundation looks strong for the years ahead.

Share This Post